By Rasheedat Oladotun-Iliyas

The Bank Verification Number, BVN introduced in 2014 is a core component of Nigeria’s Digital Public Infrastructure, DPI for financial inclusion, identity management and secure digital payments. Designed to enable banks’ Know Your Customer, KYC obligations, the BVN, now linked with National Identification Number, NIN enables them to consolidate customers’ multiple bank accounts, facilitates monitoring of cash flow and supports the reporting of suspicious transactions to relevant government agencies.

BVN enrollment requires customers to complete a form, present a valid identification card and capture two biometrics: fingerprints and facial image.These biometrics are intended to make customer verification faster, more secure and seamless during bank transactions in the banking hall. However, gaps in the enrollment process threaten the inclusivity objectives of Nigeria’s DPI framework particularly for persons with disabilities.

Akeem Lawal, Chairman, Nigeria Association of the Blind, Kwara State Chapter has raised concerns about discrimination in the process of his BVN enrollment which resulted in incomplete biometric capture and continues to limit his access to seamless banking services.

In 2014, following the Federal Government’s directive that all bank customers must register for BVN to retain access to banking services, Akeem Lawal walked into the FirstBank office, Coker branch, off Badagry expressway, Lagos, to register. As a person with visual impairment who relies on his bank account to receive his monthly salary and meet other obligations, he understood the urgency of the compliance. However, the process did not go smoothly for him like some people have described.

While his facial image was successfully captured, his fingerprints were not. According to Lawal, his inability to visually locate the fingerprint scanner, combined with what he described as the unwillingness of the bank official to provide assistance, led to repeated failed attempts.

“This happened in my own view as a result of a low level of patience on the part of the person that did my capturing. Probably because she was not very pleased in guiding me to position my fingers directly on the fingerprints panel”, he stated.

After several attempts, he was instructed to raise his hands beside his face, and only a facial image was taken. At the time, he did not realise the long-term implications of this incomplete biometric capture.

Daily banking, a source of stress, humiliation

Lawal became aware of the problem during a subsequent banking transaction when his fingerprints could not be confirmed. He was therefore asked to step out of line to go and verify his facials with a customer service representative in the banking hall.

“Ever since then, each and every time I visit the banking hall for any of the banking services, I will be made to remove my glasses and do facial capturing, which to me, does not actually go well with me because I have some deformity in my eyes. And I don’t feel comfortable sitting in the banking hall removing my glasses for people to be staring at my face, it makes me feel inhuman. I do not necessarily have to expose my challenge to the general public simply because I want to access banking services,” .he explained.

Lawal operates three bank accounts and this experience cuts across all the banks.

In addition, being the Chairman, Nigeria Association of the Blind, Kwara State Chapter, also requires him to visit banks on behalf of the association.

“It makes me go through extra stress. Sometimes, when I must have been on the queue, and when it is my turn to do certain things, it’s at that point that I will now be referred to elsewhere for face capturing instead of finger capturing that is prevalent. Sometimes to the first floor of most banks, especially for those that do not have their customer care at the ground floor,” Lawal stated.

Attempts at redress and institutional delays

For over 11 years, Lawal bore the stress like every other challenge that comes with being physically challenged, however, in 2025, he decided to end the unpleasant experience. He returned to First Bank where he did his BVN enrollment, this time around at Unity Road, in Ilorin, Kwara, to request for a complete capturing of his biometric, when it yielded no positive result. He took a step further, he sent an email to the bank’s headquarters copying the Central Bank of Nigeria, CBN, and the Federal Competition and Consumer Protection Commission, FCCPC, demanding an intervention. Despite receiving a response from First Bank acknowledging his complaint, no resolution had been provided as at the time of interaction with the reporter.

“I have been to First Bank on so many occasions, I even lost count. The response is that it is not correctable, that they cannot correct it. I have written to First Bank’s head office to lodge this same complaint, and they promised that something will be done about it. I have sent a reminder not less than six times and the response is always that they are looking at it. It’s more than six months now that I have been on it and up till now, nothing has been done about it”, Lawal noted.

A different stroke

Hadi Zakaryau, a provision store owner in Ilorin, has a similar experience but in another commercial bank. Although Hadi could not recall whether he did his BVN in 2014 or 2015, he narrated how the customer care officer had to capture his fingerprints manually because the electronic device could not detect them. As a trader, he operates a bank account to enable him to receive payments from customers, send money to his suppliers, and make other transactions.

“Anytime I need to be verified for a transaction, I usually face challenges because of the fingerprints. They will keep turning me around from one point to another. I recall when I wanted to receive some money, I spent more than four hours before I could get what I went there for,” Zakaryau stated.

By the second quarter of 2025 when Zakaryau went for another transaction, he got lucky as one of the bank officials took pity on him because of his visual impairment and ensured that his digital fingerprints were duly captured, resolving an issue that has persisted for over 10 years.

“He looked at me after spending long hours going back and forth in the banking hall. He then referred me to a customer service officer who assisted me for proper capturing of my biometrics. He placed the device at my front and directed that I put my fingers one after the other on it.

“We don’t have another option. What we want to use is in the bank and they, (the bank officials), are the ones in charge,” Zakaryau said.

Lawal who is aware that Hadi’s bank has been able to rectify his BVN issue, is pained that Firstbank appeared not to have taken his own case seriously despite many attempts. He is therefore considering a protest to drive home his demand.

“I’m considering going to the banking hall one of these days perhaps to demonstrate some level of grievances towards them because I believe, sometimes if you don’t take things to that extent, they care not to know what you are going through as an individual,” he said.

Attempt to speak to First Bank Manager at one of their branches in Ilorin was unsuccessful as the official claimed lack of authorisation to speak on the issue.

The official suggested that Lawal come to the bank to lodge the complaint himself, this however Lawal had done multiple times already.

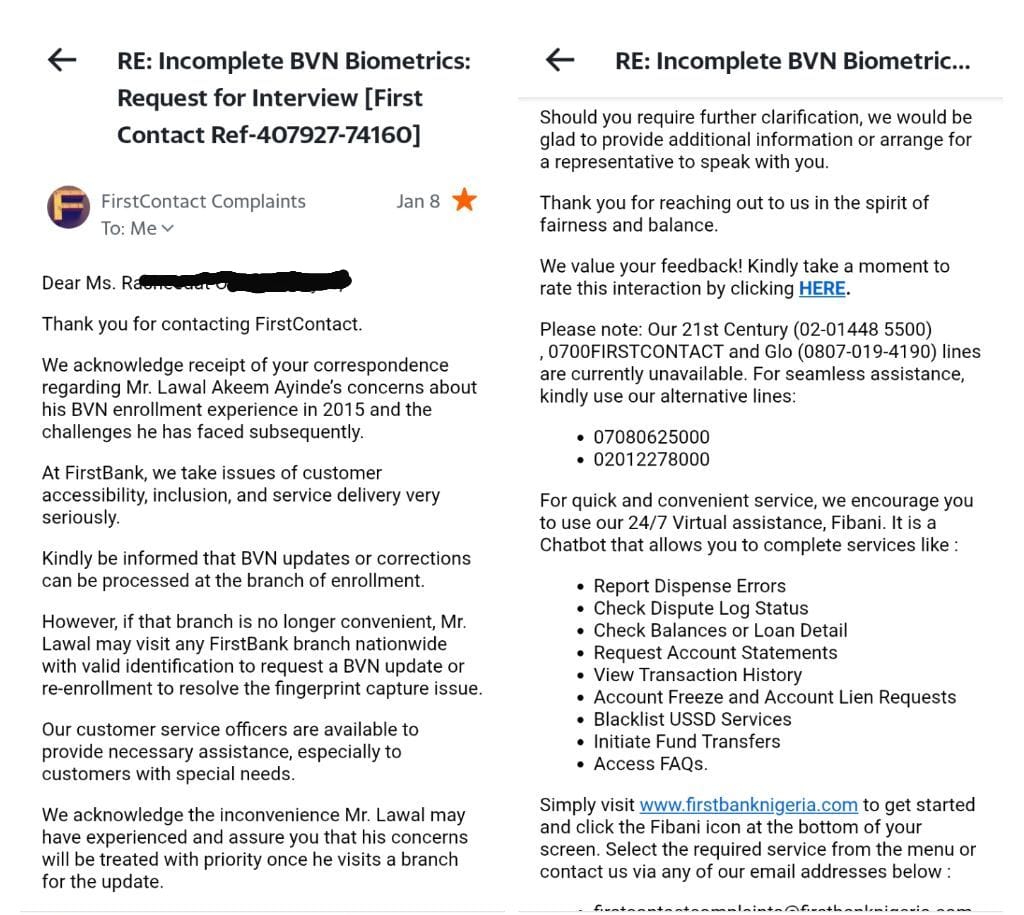

The reporter took a step further to send an email to First Bank and got a swift response which acknowledged receipt of the mail and an advisory that Lawal revisits any First Bank to lodge his complaint and seek re enrollment with a promise that “his concerns will be treated with priority.”

JONAPWD concerns

The Joint National Association of Persons With Disabilities, JONAPWD, is an umbrella body which seeks to protect the rights of persons with disabilities through advocacy and sensitization. In an interview, the Assistant Monitoring and Evaluation Officer of the association, Emmanuela Jiji, explained that JONAPWD has received a number of complaints about members who were discriminated against during biometrics capture. Emmanuela pointed out that the situation has discouraged some of them from carrying on with the registration process. “We have stories of people that have complained about registering at the bank, maybe opening bank accounts, BVN and having an ATM.”

Also, the Kwara State Chairman, Adebayo Gbadamosi, said erroneous belief that disabilities are transferable by touching or coming in contact with people that have them, exposes the PWD communities to discrimination and denial of service. He explained that some members have decided to remain without BVN enrollment because of the unpleasant experiences of others.

“They used to complain that they don’t attend to them or that people ignore them. In most cases, people do not want to touch them because they feel that they could somehow get infected with their disabilities. This has made them afraid of going so they prefer to stay back at home,” he explained.

BVN, DPI, and Financial Infrastructure

Fingerprints are a globally accepted form of biometric authentication. It is a unique natural form of identification. The fingerprints are different, even those belonging to identical twins with the same DNA.

However, experts acknowledged that fingerprints capture may fail due to age, health related reasons and work hazards or rare conditions such as adermatoglyphia which may cause absence of fingerprints. There are also reports that people who had suffered from some skin diseases including leprosy, may find it difficult to get their fingerprints captured due to loss of fingers or nerve damage.

Despite these limitations, biometric systems are expected to accommodate diversity and ensure reasonable alternatives without subjecting customers, especially persons with disabilities, to humiliation or exclusion.

Introduced in 2014, by the CBN and the Bankers Committee, the BVN initiative creates a unique identity for each bank customer, linking personal data, NIN and biometrics to all operated accounts. As of December 2025, available data by the Nigeria Interbank Settlement Systems, NIBSS shows that over 67.8 million bank accounts have been linked to BVNs. However, despite the progress made so far, a large number of bank accounts remain unverified.

Beyond banking services, the BVN also supports tracking of illicit funds by security agencies. Observers say the BVN has strengthened the digital payment ecosystem and data sharing, strengthening Nigeria’s DPI drive. With it, banking services are made faster, interoperable and secured. However, with incomplete BVN biometrics, Lawal has been excluded from the benefits of quick verification backed by DPI.

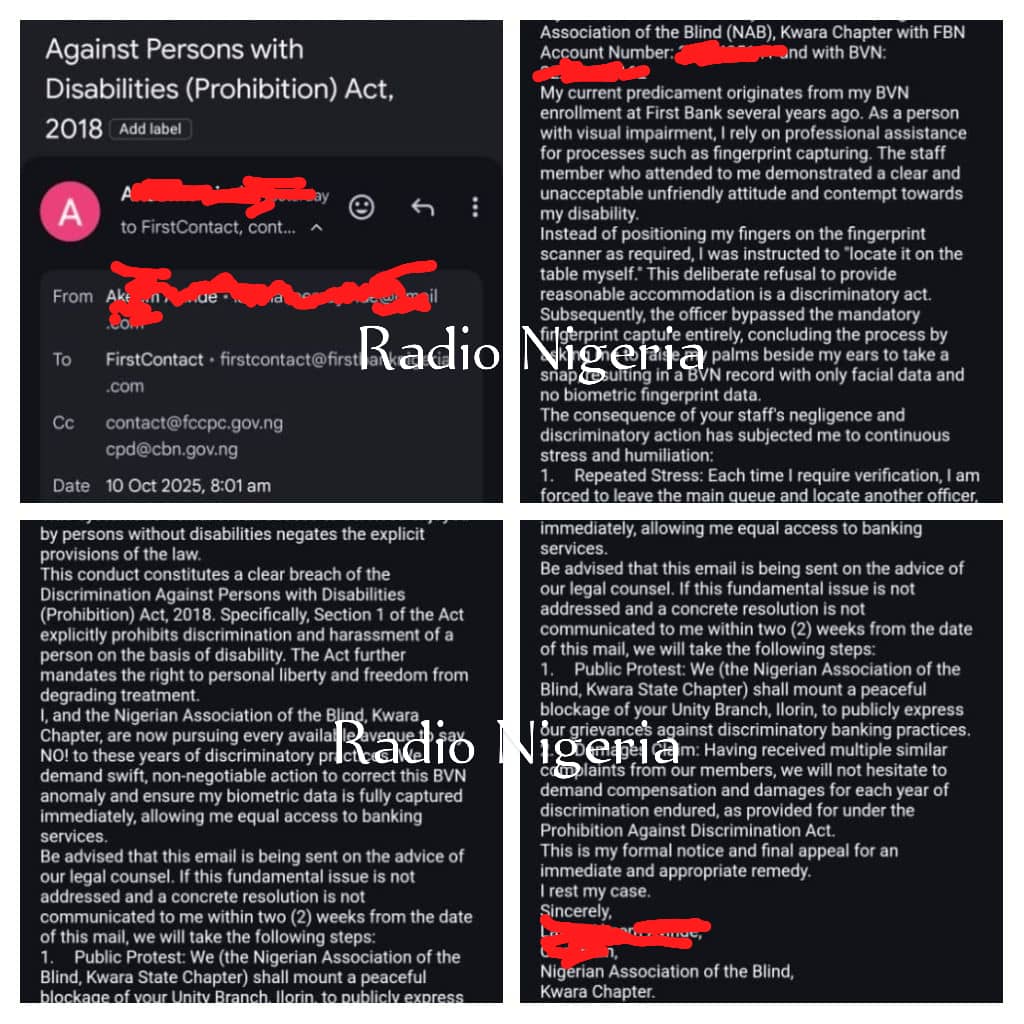

In the email dated October 10, 2025, sent to First Bank and made available to the reporter, Lawal described his situation as discriminatory and a violation of the provisions of the Discrimination Against Persons With Disabilities (Prohibition) Act, 2018 citing stress, humiliation and denial of service. He demanded a swift correction of his BVN biometrics to enable him to have equal access to banking services.

The letter titled: Formal Complaint Regarding Discriminatory BVN Enrolment and Demand for Rectification: Violation of the Discrimination Against Persons With Disabilities (Prohibition) Act, 2018, was sent to the bank (firstcontact@firstbanknigeria.com), and copied the FCCPC (contact@fccpc.gov.ng), and the CBN (cpd@cbn.gov.ng).

Later, Lawal received a response from the bank assuring him of a resolution but till December 30th, 2025, he was yet to get a solution.

Under the CBN Approved Service Charter, a customer who wants to lodge a complaint will be required to follow some steps. In the first step, the complaint will first be brought to the notice of the bank through the designated reporting channels; basic information will be provided in the complaint. Failure of the bank to resolve the issue within the given timeframe, two weeks, or 30 days for excess charges and loan, then the customer can escalate it to the consumer protection council of the CBN. Records of previous communication will be required.

NIBSS, established in 1993 and operational since 1994, serves as Nigeria’s core financial infrastructure, enabling interoperable digital payments such as NIBSS Instant Payment (NIP) and BVN services.

At a Media Foundation for West Africa (MFWA) workshop, NIBSS Head of Business Operations, Ekeoma Chidi Ugborji, described Lawal’s experience as unfortunate, particularly given the absence of any finger deformity that would prevent authentication. She noted that fingerprints are the most appropriate means of identification for persons with visual impairment but clarified that BVN corrections can only be effected by NIBSS upon request from the concerned bank.

In their work in African Disability Rights Yearbook, AI Ofuani-Sokolo and O Muonye, listed the negative attitude of staff of Financial Service Providers, FSPs and inadequate attention to PWDs, as some of the factors hindering equity, diversity and inclusion in banking services. They distinguished between accessibility for PWDs and the concept of reasonable accommodation while advocating individualised services to PWDs. Central to this is the Duty of Care and procedural help in guiding customers through completion of forms, enrollment process and the likes.

Nigeria is signatory to international and regional regulatory frameworks including the Convention on the Rights of Persons With Disabilities, CRPD, and the African Disability Protocol, the Discrimination Against Persons With Disabilities Prohibition Act which became operational in 2024. These frameworks, alongside National Consumer Protection Regulations, prohibit discrimination and mandates reasonable accommodation for persons with disabilities.

Researchers, however, argue that gaps in implementation, inadequate staff training, and weak enforcement continue to undermine equity, diversity, and inclusion in financial services.

————————————————

This report is produced under the DPI Africa Journalism Fellowship Programme of the Media Foundation for West Africa and Co-Develop